Briefing Package for CFIA Deputy Head, 2023

February 2023

On this page

- Overview

- Role of the President

- Legislative Mandate

- Division of Responsibilities between Ministers

- Core Responsibilities

- Organizational Structure

- Governance Structure

- Emergency Management

- CFIA National Presence

- Regional Operations

- Annex A: International Landscape

- Annex B: Federal-Provincial-Territorial (FPT) Landscape

- Human Resources and Finance

- CFIA Partners

Overview

With a vision to excel as a science-based regulator, trusted and respected by Canadians and the international community, the CFIA is dedicated to safeguarding food, animals and plants, which enhances the health and well-being of Canada's people, environment and economy

Role of the President

Pursuant to the Canadian Food Inspection Agency Act, the President is chief executive officer of the Agency with authority to:

- Set the strategic direction and manage the organization to successfully fulfill its mandate

- Provide leadership, promote collaboration, encourage innovation and a results-oriented organizational environment

- Support the Minister of Health and the Minister of Agriculture and Agri-Food in fulfilling their responsibilities

Legislative Mandate

Develop and deliver inspection and other services to:

- Prevent and manage food safety risks (e.g., food recalls)

- Protect plant resources from pests, diseases and invasive species (e.g., emerald ash borer)

- Prevent and manage animal diseases (e.g., African swine fever (ASF), bovine spongiform encephalopathy (BSE), chronic wasting disease (CWD), etc.), including diseases that threaten human health (e.g., avian influenza)

- Contribute to consumer protection (e.g., labelling claims)

- Facilitate market access for Canada's food, plants and animals

- Conduct innovative research to make science-based decisions

Division of Responsibilities between Ministers

Minister of Health

Responsible for:

- Overall direction of the CFIA

- Establishing policies and standards relating to the safety and nutritional quality of food sold in Canada and assessing the effectiveness of the Agency's activities related to food safety

Food safety:

- Food and Drugs Act

- Safe Food for Canadians Act

Minister of Agriculture and Agri-food

Responsible for:

- The non-food safety legislation administered and enforced by the CFIA, including the facilitation of market access, animal health and plant protection

- The Agency is responsible for the administration and enforcement of the Agriculture and Agri-Food Administrative Monetary Penalties Act and the following:

- Plants:

- Fertilizers Act

- Plant Protection Act

- Seeds Act

- Plant Breeders' Rights Act

- Animals:

- Feeds Act

- Health of Animals Act

- Non-food safety:

- Safe Food for Canadians Act

- Food and Drugs Act

- Plants:

Core Responsibilities

Plant Health, Animal Health, Food Safety, International Trade

- A regulator:

- To set rules and verify compliance with the rules

- A risk manager:

- To mitigate diverse public risks related to public health, economics and environment

- A facilitator:

- To improve the regulatory interface with industry and trading partners

Food Safety

Safeguard Canada's food supply

- Includes health and safety and labelling

- Administering and enforcing Safe Food for Canadians Regulations, Food and Drugs Act, and Food and Drug Regulations (as it relates to food)

- Shared responsibility between CFIA, industry, international partners, Public Health Agency of Canada, Health Canada and municipal, provincial and territorial authorities

Minimize health and safety risks to Canadians by:

- Protecting Canadians from preventable food safety hazards

- Managing food safety investigations and recalls effectively

Contributes to consumer protection by:

- Verifying information provided to Canadian consumers through labels and advertising is truthful and not misleading

Plant Health

Protect Canada's plant resource base

- Includes crops, horticulture, nurseries, forest resources and products, greenhouses, seeds, fertilizers, plants with novel traits

Protect Canada's plant resource base, environment and plant-related industries by:

- Preventing the introduction and spread of pests that could damage Canadian production and the income of Canadian producers

- Verifying farmers have access to safe, effective and innovative agricultural inputs (e.g., seed, fertilizer) that support environmental sustainability

- Fostering innovation through protection of intellectual property (i.e., plant breeders' rights)

- Maintaining the reputation of Canadian agricultural products in the global marketplace as being high-quality, pest free and safe

Animal Health

Protect Canada's animal resource base and Canadians from diseases

- Includes livestock, poultry, animal feeds, vaccines and fish and seafood

Minimize risks to Canada's terrestrial and aquatic animal resource base, and ensure the safety of animal feeds, products and vaccines by:

- Protecting Canada's animals, including aquatic animals, from diseases

- Managing animal disease incidents and emergencies (e.g., African swine fever (ASF), Bovine spongiform encephalopathy (BSE), Chronic Wasting Disease (CWD), etc.), including diseases that threaten human health (e.g., avian influenza, coronaviruses, etc.)

- Promoting and regulating animal welfare, in transportation and in slaughter

- Verifying that animal feeds and vaccines are safe and effective

International Trade

Facilitate market access for Canada's plants, animals and food

Contribute to market access for Canadian agriculture and agri-food by:

- Influencing the development of international rules and standards for plant protection, animal health and food safety through international standard-setting bodies

- World Organisation for Animal Health (WOAH)

- Codex Alimentarius Commission (CODEX) (Food)

- International Plant Protection Convention (IPPC)

- Engaging trading partners

- Negotiating import/export conditions and technical agreements and standards

- Working in collaboration with Agriculture and Agri-Food Canada and Global Affairs Canada

Organizational Structure

CFIA's organizational structure is led by two (2) senior executives. The President, Dr. Harpreet S. Kochhar, and the Executive Vice-President, Jean-Guy Forgeron. Under the 2 senior executives are 11 executives that oversee different sections of CFIA.

Delivery of CFIA mandate:

- Sylvie Lapointe, Vice-President of Policy and Programs (PPB), provides strategic policy advice and sets out program policies and procedures

- Diane Allen, Vice-President of the Science Branch, provides scientific leadership, advice and laboratory services to contribute to an effective science-based regulatory agency

- Philippe Morel, Vice-President of the Operations Branch (Ops), delivers inspection programs and takes compliance and enforcement action

- Kathleen Donohue, Assistant Deputy Minister of the International Affairs Branch, leads on market access and international regulatory trade issues

- David Nanang, Associate Vice-President of Operations, delivers inspection programs and takes compliance and enforcement action

Corporate services:

- Dr. Raman Srivastava, Vice-President of Human Resources, enables talent identification, acquisition and mobilization

- Stanley Xu, Vice-President of Corporate Management (CM) and Chief Financial Officer (CFO), provides oversight of financial management and assets and security management

- Jane Hazel, Vice-President of Communications and Public Affairs, delivers internal and external communication services

- Martin Rubenstein, Chief Audit Executive and Head of Evaluation of Audit and Evaluation, provides evidence-based advice and assurance to senior management

Both corporate services and delivery of CFIA mandate:

- Todd Cain, Chief Innovation and Information Officer, delivers on major projects and priority change initiatives and enables information and information technology

Shared services with Agriculture and Agri-Food Canada:

- Kristine Allen, Executive Director and Senior General Counsel, Legal Services, provides legal services to the CFIA and Agriculture and Agri-Food Canada

Governance Structure

Description for governance structure

The first tier: Strategic direction and ongoing oversight for Agency's management and priorities that include the President and Senior Management Committee which the President chairs.

Second tier: Horizontal corporate, policy, programs and business planning that include the Policy and Planning Committee which is starting in February as well as the Corporate Governance Committee that is co-chaired by the VP Ops and the VP of CMB and CFO.

Third tiers: Business Line tactical and strategic planning and implementation and oversight. This tier includes:

- Animal Health Business Line Management Board chaired by the Executive Director for PPB and Vice-Chair the Executive Director for Ops.

- Food Business Line Management Board chaired by the Executive Director of PPB and Vice-Chair by the Executive Director for Ops.

- Plant Business Line Management Board, chaired by the Executive Director of PPB and Vice-Chair by the Executive Director for Ops.

- Change Management Committee, chaired by the Executive Director of Innovation, Business, and Service Development Branch (IBSDB) and Vice-Chair by the Executive Director for Ops.

- People, Project & Financial Management Committee, chaired by the Executive Director of CMB and Vice-Chair by the Executive Director for Human Resources (HR).

- Branch Executive Committees, chaired by Branch Head

- Information Governance Committee, chaired by the Chief Data and Risk Officer and co-chair by the Executive Director of PPB.

Emergency Management

The Emergency Management Act (2007) requires Ministers to identify the risks that are within or related to their area of responsibility and to prepare emergency management plans with respect to those risks.

Within its mandate CFIA has a strong emergency management foundation in place to address animal health, plant health and food safety incidents (see below).

Prevention and Mitigation

Each of the Agency's programs contribute to the prevention and mitigation of emergencies through activities such as on-going intelligence and risk assessment, import controls, surveillance testing and inspection activities, and the development of regulations

Preparedness

In addition to the plans and procedures and an emergency responder inventory, the Agency maintains a National Emergency Operations Center (NEOC) at headquarters and Emergency Operations Centres in the Areas to allow for support and coordination of responses

Response

The Agency mobilizes response teams structured on the Incident Command System and responds guided by the appropriate hazard specific-plans and procedures. The response teams are supported by all Agency branches, as required

Recovery

Following an emergency, the Agency develops a plan to move back to normal operations and supports recovery through activities such as surveillance and compensation to affected stakeholders.

A lessons learned review process, and implementation of corrective actions are also part of recovery

Emergency Response and Preparedness

- During an emergency, a National Emergency Operations Centre Management team is established to provide strategic direction and coordination at the national level

- This team is made up of specialists who are drawn from all branches, and report to the accountable executive for the event

- Tactical response is led out of the affected Area/Region

- The Agency is currently responding to the outbreak of Avian Influenza across Canada

- Ongoing preparedness activities for African Swine Fever are also underway, led by an incident command system team

Emergency Response – Past and Present

| Year | Event | Location | Type |

|---|---|---|---|

| 2004-2005 | Avian influenza | British Columbia | Animal health |

| Bovine spongiform encephalopathy | British Columbia | Animal health | |

| 2005-2006 | Avian influenza | British Columbia | Animal health |

| 2006-2007 | Potato cyst nematode | Quebec | Plant health |

| 2007-2008 | Avian influenza | Saskatchewan | Animal health |

| Potato Cyst Nematode | Alberta | Plant health | |

| Potato wart | Prince Edward Island | Plant health | |

| British Columbia floods | British Columbia | Non-mandated emergencies and special events | |

| 2008-2009 | Melamine, imported dairy and infant formulas | Canada | Food safety |

| E. Coli | Ontario | Food safety | |

| 2009-2010 | Avian influenza | British Columbia | Animal health |

| H1N1 pandemic | Canada | Non-mandated emergencies and special events | |

| Anaplasmosis | British Columbia | Animal health | |

| Listeria monocytogens | Ontario | Food safety | |

| 2010-2011 | Vancouver Olympics | Canada | Non-mandated emergencies and special events |

| Salmonella, hydrolyzed vegetable proteins | Canada | Food safety | |

| Anaplasmosis | British Columbia | Animal health | |

| G8/G20 Summit | Canada | Non-mandated emergencies and special events | |

| Listeria monocytogens | Canada | Food safety | |

| Salmonella, head cheese | Canada | Food safety | |

| Avian influenza | Manitoba | Animal health | |

| 2011-2012 | Japan earthquake and tsunami, radioactivity testing of imported food | Canada | Food safety |

| di(2-ethylhexyl)phthalate (DEHP), imported food from Taiwan | Canada | Food safety | |

| 2012-2013 | Infectious salmon anemia | Atlantic | Animal health |

| E. Coli, XL Foods | Canada | Food safety | |

| E. Coli, Cardinal Meats | Canada | Food safety | |

| 2013-2014 | E. Coli, cheese | British Columbia | Food safety |

| 2014-2015 | Porcine epidemic diarrhea, contaminated feed | Canada | Feed |

| Avian Influenza | British Columbia | Animal health | |

| 2015-2016 | Bovine spongiform encephalopathy | Alberta | Animal health |

| Avian influenza | Ontario | Animal health | |

| Parapan American Games | Canada | Non-mandated emergencies and special events | |

| 2016-2017 | Bovine tuberculosis | Alberta | Animal health |

| Avian influenza | Ontario | Animal health | |

| 2017-2018 | Wheat, non-authorized genetically modified crops | Alberta | Plant health |

| 2018-2019 | G7 Summit | Canada | Non-mandated emergencies and special events |

| African swine fever planning | Canada | Animal health | |

| Bovine tuberculosis | British Columbia | Animal health | |

| 2019-2020 | Ractopamine, exports to China | Canada | Food safety |

| African swine fever planning | Canada | Animal health | |

| 2020-2021 | COVID-19 pandemic | Canada | Non-mandated emergencies and special events |

| African swine fever planning | Canada | Animal health | |

| 2021-2022 | African swine fever, outbreak in Dominican Republic | Canada | Animal health |

| 2022-2023 | Potato wart | Prince Edward Island | Plant health |

| Avian influenza | Canada | Animal health |

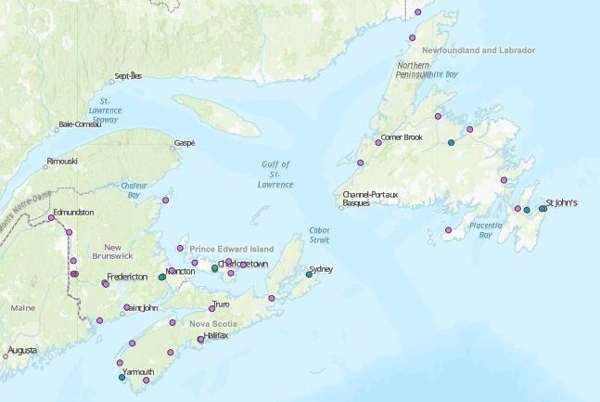

CFIA National Presence

Area and Regional Offices

Atlantic Area:

- New Brunswick (Moncton)

- New Brunswick (Fredericton)

- Prince Edward Island (Charlottetown)

- Newfoundland and Labrador (St. John's)

Quebec Area:

- Montreal East

- Montreal West

- St. Hyacinthe

- Quebec City

Ontario Area:

- Northeast (Barrie)

- Toronto (Downsview)

- Central (Guelph)

- Southwest (London)

Western Area:

- Manitoba (Winnipeg)

- Alberta South (Calgary)

- Alberta North – Saskatchewan (Edmonton)

- British Columbia (Burnaby)

Laboratories:

- Atlantic (2)

- Quebec (2)

- Ontario (3)

- Western (6)

Regional Operations

Western operations

- Director General: Kelvin Mathuik

- Senior Director: Rick James-Davies

- Regions/Directors of Operations

- Manitoba: Craig Koenig

- Northern Alberta/Saskatchewan: Cristel Waldbauer

- Southern Alberta: Trevor Janzen

- BC Plant and Food: Matt Miyagawa

- BC Animal and Food: A/Janice Bridgland

FTEs - Western Area

- Inspection: 1088 (84%)

- Non-Inspection: 201 (16%)

30 CFIA offices

- 1 Area

- 5 Regional

- 24 District

Area governanace Structure

Area Executive Committee

- Financial Management Committee

- Human Resources Committee

- Corporate Management Committee

- Operations Committee

- Plant Health Sub-Committee

- Food Sub-Committee

- Animal Health Sub-Committee

- Slaughter Sub-Committee

Top CFIA-regulated industries in the west

Food

- Animal slaughter

- Meat processing

- Meat storage

- beef

- pork

- poultry

- horse

- Fish (including freshwater and shellfish)

- Fresh fruits and vegetables (including onions, potatoes, hot house peppers, blueberries and cherries)

Animal Health

- Beef

- Dairy

- Swine

- Poultry

- Aquaculture

On a smaller scale:

- Small ruminant (sheep, goat)

- Bison

- Cervid (deer and elk)

- Bee/honey production

Plant Health

- Forestry (logging exports)

- Table and seed potatoes

- Greenhouse and nursery plants

- Grain and oilseed industry

- wheat

- rye

- soybeans

- oilseeds

- peas

- beans

CFIA-provincial/territorial highlights

The Western Area has positive and collaborative relationships with provincial counterparts, and continues to further relationships with the Yukon, Northwest Territories and Nunavut. Engagement with provincial counterparts occurs on a quarterly basis through virtual and face-to-face meetings.

Key Partners

- British Columbia Agriculture

- British Columbia Health

- Alberta Agriculture and Forestry

- Alberta Health

- Saskatchewan Agriculture

- Saskatchewan Health

- Manitoba Agriculture, Food and Rural Initiatives

- Manitoba Health, Seniors and Active Living

Key Files

- Food

- Engagement related to Safe Food for Canadian Regulations

- Canadian Shellfish Sanitization Program (CSSP)

- Animal Health

- Notifiable Avian Influenza (NAI) Response

- Chronic Wasting Disease (AB and SK)

- African Swine Fever (ASF) Preparedness

- Plant Health

- Japanese Beetle (BC)

Additional information

- Cargill Meat Solutions in High River (Alberta) and JBS Foods Canada in Brooks (Alberta) are the largest beef operations in Canada with a combined slaughter capacity of over two million cattle annually, accounting for over 80% of beef slaughter production in Canada. Each of the establishments employs over 2000 employees with approximately 40-50 CFIA inspection staff. There is also onsite animal byproduct rendering operation at each establishment that produces animal feed

- Inspection activities are conducted at well over 250 honey houses, contributing to the production of 50 million pounds of honey

- There is an increasing demand in the manufactured food sector

- The Phyto Processing Office (PPO) in Regina (Saskatchewan) issues the highest number of grain and oilseed phytosanitary certificates (PCs) in the country

- Pedigreed seed production and forage crops are also important industries in the West, particularly in the prairie provinces

- Hay producers in British Columbia and Alberta are audited by the CFIA to allow them to ship heat treated hay to China

- The West Coast is a hub of import and export activity, in particular related to the forestry and logging industry - export of logs and lumber; and domestic pest surveillance to detect and respond early to potential risks to Western Canada's forests and associated industries

- British Columbia's top plant health commodities include fresh fruits, greenhouse and field vegetables, flowers, and ornamental nursery stock

- The Okanagan-Similkameen Valley in the Interior of British Columbia is a major growing region for pome (apples/pears) and stone fruit crops as well as grapes, melons and other field grown vegetables.

Ontario operations

- Director General: Kevin Urbanic

- Senior Director: Pamela MacDonald

- Regions/Directors of Operations

- Northeast Region: Wade McCambley

- Toronto Region: Peter DeSouza

- Central Region: Jennifer Martin

- Southwest Region: Jennifer Finck

FTEs - Ontario Area

- Inspection: 875 (88%)

- Non-Inspection: 114 (12%)

29 CFIA offices

- 1 Area

- 4 Regional

- 24 District

Area governanace Structure

Executive Management Committee

- Area Program Management Committee

- Occupational Health & Safety Committee

- Area Corporate Management Committee

- Union-Management Consultation Committee

- Respectful Workplace & Wellness Committee

- Inclusiveness & Diversity Committee

- Human Resources Committee

Top CFIA-regulated industries in Ontario area

Food

- Slaughter (beef, pork, poultry)

- Import/export (meat, dairy, fish, fresh produce)

- Processing (meat/fish/dairy)

- Greenhouse (pepper, cucumber, tomato)

Animal Health

- Artificial insemination (bovine and swine)

- Commercial poultry (export and hatching eggs)

- Hatcheries (poultry, fish)

- Livestock assembly/sale centers

- Animal by-product production for export

- Federally registered red meat/poultry slaughter plants

Plant Health

- Importers/exporters:

- Forestry (log, lumber)

- Horticulture (nursery, greenhouses)

- Grain and field crops

- Seed

CFIA-provincial key highlights

Partners

- Ontario Ministry of Agriculture, Food and Rural Affairs (OMAFRA)

- Ontario Ministry of Natural Resources and Forestry (OMNRF)

- Ministry of the Solicitor General – Animal Welfare Services (SOLGEN AWS)

- Ministry of Natural Resources and Forestry

- How we engage: through in-person and/or hybrid meetings held on a quarterly or semi-annual basis and as needed to address matters of mutual interest.

Areas Of Collaboration

- Humane transportation

- Animal welfare

- Foreign animal disease and response

- Plant pest management (kudzu, hemlock woolly adelgid, Asian long horned beetle)

- Ontario Foodborne Illness Outbreak Response Protocol (FIORP)

- Spotted Lanternfly

Committee Participation

- Foodborne Outbreak and Recall Committee (FORC)

- Interagency Council on Food Safety (ICFS)

- Ontario Critical Plant Pest Management Committee (OCPMC)

- Food Integrity Committee

The Umbrella memorandum of understanding (MOU) is the overarching agreement and template that supports collaboration with OMAFRA.

Additional information

- CFIA services residing in Ontario: National Import Service Centre (NISC) & Accounts Payable Service Centre

- Ontario serves Pearson International Airport (Canada's largest/busiest airport), Windsor-Detroit (Canada's busiest land border crossing), Sarnia (Ontario's highest volume of live animal imports), Canada's busiest international mail centre & the largest international rail crossing in North America is located between Fort Frances, ON and International Falls, MN

- Ontario Food Terminal (Toronto) is the largest wholesale fruit and produce distribution center in Canada, and third largest in North America distributing over two billion pounds of produce annually (an average 5.6 million pounds per day)

- Ontario serves Canada's two largest poultry slaughter establishments, the newly opened (Nov. 28, 2022) Maple Leaf Foods (MLF) mega plant (Est.901) in London (slaughter capacity of [Redacted text]) and Maple Lodge Farms Ltd. (Est. 285) in Brampton (slaughter capacity of [Redacted text]). Maple Leaf Foods also operates a ready-to-eat (RTE) super plant in Hamilton – one of the largest RTE processing facilities in Canada.

- Ontario manages between 45% - 55% of all food CFIA recalls (20-25% of all food safety investigations initiated by the Toronto Region).

- Covers the largest concentration of fish importers in Canada (400+)

- Ontario is home to the world's largest inland concentration of grain elevators; highest concentration of vegetable greenhouses in North America (Southwest Ontario) and where nearly 100% of Canada's seed corn is grown

- In 2022, Ontario responded to the detection of avian influenza at 43 infected premises

- Collect ~8,000-9000 bovine spongiform encephalopathy (BSE) samples annually contributing to Canada's overall BSE sample targets

- Canada's two largest exporters of swine genetics are located in Ontario

- The highest volume of pet exports in the country is processed by the Markham District office

- In a typical year, across the food, plant & animal business lines, Ontario completes a total of over 85,000 inspections, issues over 78,000 export certificates and collects over 19,000 samples

Quebec operations

- Director General: Sandra Gagné

- Senior Director: Louis-Philippe Vaillancourt

- Areas and Directors of Operations

- Quebec: Marie-Josée Beaulieu

- Central Quebec: Andréa Frenette

- Montréal: Frédérique Trives

- St-Hyacinthe: Dominic Bélanger, Acting

FTEs - Quebec Area

- Inspection: 710 (90%)

- Non-Inspection: 102 (10%)

19 CFIA offices

- Three regional offices:

- Montréal

- Director general (DG) and Director of operations (DO) teams

- Montréal region

- St-Hyacinthe/Central

- Québec

- Montréal

- 14 districts and local offices

Area goveranace structure

Operations Executive Committee

- Human Resources Committee

- Operations Management Committee

- Equity and Diversity Committee

- Union Management Committee

- Occupational Health and Safety Committee

- Operational Issues Management Committee

- Management Services Committee

Top CFIA-regulated industries in Quebec area

Food

- Slaughter (poultry, red meat)

- Import/export (meat, dairy products, fish fresh fruits and vegetables)

- Processing (meat/fish/dairy products)

- Imported and manufactured food

Animal Health

- Artificial insemination centres (bovines and porcines)

- Hatcheries

- Renderers

- Feed mills

- Livestock auctions and gathering places

- Pet food manufacturing establishments for export

- Federally registered abattoirs (poultry, red meat)

Plant Health

- Import/export

- Forest industry (logs, lumber, Christmas trees)

- Horticulture industry (nursery/greenhouses)

- Grains/seeds

- Maritime industry (ship inspection, dunnage)

- Golden nematode (St- Amable): restricted area management

CFIA provincial highlights

- The CFIA has an excellent relationship with the Ministère de l'Agriculture, des Pêcheries et de l'Alimentation du Québec (MAPAQ), which is our gateway to all other provincial departments; Various levels of CFIA-MAPAQ governance are well established and based on communication and mutual assistance;

- CFIA-MAPAQ inspection agreements have been in effect since 1998, establishing a division of food establishments in Quebec based on a "one establishment/one jurisdiction" basis.

Key Collaboration Areas (CFIA-MAPAQ)

- Review inspection agreements to adapt them to the current regulatory environment.

- Provide CFIA Fresh Fruit and Vegetable (FFV) samples for Quebec's pesticide residue monitoring program.

- Implement emergency measures related to African swine fever and avian influenza.

- Maintain collaboration to ensure compliance with federal requirements for pork traceability.

- Consumer complaints (400/year) are initially received by MAPAQ, which, after an initial investigation, are referred to the CFIA when follow-up is required with a federal establishment.

- Maintain collaboration on animal welfare, human transportation and removal of specified risk materials (SRM) from food and feed.

- Maintain collaboration in the management of CFIA regulated pests.

- Maintain close relationship with the province through frequent discussions at various levels, in addition to holding a strategic meeting between our teams at least once a year.

Additional information

Diversity and Disparity of Agricultural Production and Food Processing Sectors in the Territory

- Quebec's agricultural and agri-food industry, although strongly represented by supply- managed production (milk, eggs, poultry), is characterized by its many sectors (pork, horticulture, maple syrup, food processing) whose activities are present throughout Quebec.

- This requires a variety of expertise from CFIA staff. In addition, it means that many inspection activities involve extensive travel by car, plane or boat. Therefore, inspectors spend a lot of time traveling.

- Border crossings for goods entering the country (sea, land and air): Port of Montreal, Pierre Elliot Trudeau Airport and several border crossings.

- Postal sorting center located in Montréal covers Quebec and the Atlantic region.

Safe Food for Canadian Regulations (SFCR)

- Quebec has over 4,229 licences obtained under the Safe Food for Canadians Regulations (SFCR). This figure accounts for approximately 20% of Canadian licences.

Response to Highly Pathogenic Avian Influenza

- In Quebec, highly pathogenic avian influenza has required a CFIA response to 23 poultry sites declared infected. Since April 2022, 180 Quebec Operations staff have been deployed to this situation and, since September 2022, 30 Quebec staff have been deployed to the West to provide support.

Human Resources

- 18% of Quebec staff will be eligible to retire within the next five years.

- Difficulties in recruiting veterinarians: at CFIA, more veterinarians are leaving the Agency (retirement, return to the private sector, etc.) than are being hired. New resources remain insufficient and the need for veterinarians remains more important than ever in all sectors of activity.

Close Ties Between the Population and Its Elected Officials

- Quebec residents maintain a very close relationship with their elected representatives; therefore, the CFIA often receives questions about office closures, new regional economic development projects, closures of shellfish harvesting areas, etc.

Discussions with First Nations

- Several issues (fish/shellfish/blueberry maggot/seal product/emerald ash border) involve discussions with Aboriginal communities.

Atlantic operations

- Director General: Kathy Brewer-Dalton

- A/Senior Director: Serge Gaudet

- Regions/Directors of Operations

- New Brunswick: Andrew Justason

- Nova Scotia: Sherry Lynn Kelly

- Prince Edward Island: Lynn MacVicar

- Newfoundland & Labrador: Michael Hiscock

FTEs - Atlantic Area

- Inspection: 417 (78%)

- Non-Inspection: 117 (22%)

42 CFIA Offices in Atlantic Area

- 1 Area office

- 4 Regional offices

- 37 District offices

Top CFIA-regulated industries in atlantic area

Fish

- 542 CFIA registered fish establishments in the Atlantic Area (NS-51%, NL-19%, NB-20%, PEI-10%)

- 50% of Canada's fish establishments are located in the Atl. Area

- $6.7 billion worth of seafood exported from the Atl. Area in 2021

Potatoes

- 136,000 acres of potatoes planted in Atlantic Canada in 2021

- 63% (PE) and 36% (NB) of Atlantic Canada total potato acreage

- 222 K tons of potatoes exported from Atlantic Canada in 2021 (49% of Canadian total)

Additional information

- Supported emergency responses in the Atlantic Area (HPAI and PW response) and also in other parts of Canada (HPAI response)

- Significant efforts dedicated to the Potato Wart emergency response in Prince Edward Island

- Implementation of the electronic TRACES NT system

CFIA-Provincial key highlights

- Collaborative, positive relationships with provincial colleagues

- CFIA mandate links to 18 provincial departments within the four Atlantic provinces

- How we engage: hybrid – face to face biannual meetings and virtual ad hoc meetings as required

NB

- NB Department of Agriculture, Aquaculture and Fisheries

- NB Department of Environment and Local Government

- NB Department of Natural Resources and Energy Development

- NB Department of Health

- NB Department of Justice and Public Safety

NS

- NS Department of Agriculture

- NS Department of Environment

- NS Department of Fisheries and Aquaculture

- NS Department of Natural Resources and Renewables

- NS Department of Health

PE

- PE Department of Agriculture and Land

- PE Department of Environment, Energy and Climate Action

- PE Department of Fisheries and Communities

- PE Department of Health and Wellness

NL

- NL Department of Fisheries, Forestry and Agriculture

- NL Department of Health and Community Services

- Digital Government and Service NL

- NL Executive Council

Area governance structure

Atlantic Operations Executive Committee

- Atlantic Consultation Committees

- Atlantic Occupational Health and Safety Community

- Atlantic Union Management Committee

- Atlantic Key Initiatives Committees

- Atlantic CFIA Committee

- Atlantic Official Languages Committee

- Atlantic Diversity Committee

- Atlantic Synapse Committee

- Business Management Teams

- Human Resources and Corporate Management Committee

- Atlantic Continuous Improvement Team

- Atlantic Animal Advisory Community

- Atlantic Plant Advisory Community

- Atlantic Food Advisory Community

Annex A: International Landscape

Top Markets and Exports

Main Canadian agri-food and seafood exports by major sector

In 2021, Canadian agri-food and seafood exports reached $82.3 billion compared to $74.1 billion for 2020, representing a 10.9% increase.

- Non Durum Wheat: 6,017.4 million in Canadian dollars

- Canola Seed: 5,888.6 million in Canadian dollars

- Canola Oil: 4,856.9 million in Canadian dollars

- Bread & Baked Goods: 3,066.5 million in Canadian dollars

- Beef (exclude Bison): 4,130.9 million in Canadian dollars

- Pork (including casings): 4,636.3 million in Canadian dollars

- Canola Meal: 1,945.9 million in Canadian dollars

- Frozen French Fries: 1, 477.6 million in Canadian dollars

- Seafood: 1,885.4 million in Canadian dollars

Key Canadian agri-food and seafood export destinations and share of total exports (2021)

- Japan, 6.3%

- China, 11.5%

- EU without UK, 4.9%

- All other destinations, 18.5%

- Mexico, 3.3%

- United States, 55.5%

Exports are highly concentrated, with 81.5% of exports in 2021 going to five markets

Trade Agreements

- The Government of Canada is a signatory to international agreements that confer rights and obligations, including in areas within the CFIA's remit

- CFIA leads on the implementation of the World Trade Organisation (WTO) Agreement on the Application of Sanitary and Phytosanitary (SPS) Measures:

- To protect against risks to food safety, animal or plant life or health

- To maintain the sovereign right of governments to provide the level of health protection it deems appropriate, while ensuring that these sovereign rights are not misused for protectionist purposes and do not result in unnecessary barriers to international trade

- CFIA supports the implementation of the WTO Agreement on Technical Barriers to Trade (TBT):

- Governs non-SPS measures (e.g., labelling for purposes of quality or nutrition), as well as other agreements that relate to the CFIA's mandate

- CFIA co-leads, with Global Affairs Canada, the negotiation of the SPS chapters of bilateral Free Trade Agreements (FTAs), and provides advice and support for other chapters that relate to the Agency's mandate, e.g., TBT, Regulatory Cooperation, Intellectual Property (IP) and Environment:

- CFIA's objective for SPS chapters in FTAs is to protect Canada's right to take the measures necessary to keep Canadians safe and protect its domestic resource base, while seeking provisions and mechanisms that facilitate trade

Current Multilateral Free Trade Agreements negotiations

- Canada – United Kingdom Free Trade Agreement

- United Kingdom Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) Accession

- Canada – India Comprehensive Economic Partnership Agreement

- Canada – Indonesia Comprehensive Economic Partnership Agreement

- Canada – Association of Southeast Asian Nations (ASEAN) Free Trade Agreement

- Canada – Mercosur Free Trade Agreement

Examples of Bilateral Free Trade Agreements Agreements with the following markets

- Chile

- Colombia

- Costa Rica

- European Union

- Honduras

- Israel

- Jordan

- Korea

- Panama

- Peru

- Ukraine

- United Kingdom

Annex B: Federal-Provincial-Territorial (FPT) Landscape

Overarching FPT Landscape

- Manitoba assumed Chair of the Council of the Federation, September 2022

- East/West and rural/urban political divides growing

- Constitutional issues continue to simmer (Saskatchewan First Act, Alberta Sovereignty within a United Canada Act)

- Some provinces pushing back against perceived federal regulatory burden

CFIA Context

- CFIA reports to Minister of Agriculture and Agri-Food on economic, trade, plant and animal health issues, and to Minister of Health on food safety

- Jurisdiction over agriculture is shared between the federal and provincial governments (s. 95, Constitution Act, 1867)

- CFIA mandate extends to aquatics, forestry and the environment; may need to engage with more than one ministry in each province/territory

Key FPT Engagement at the CFIA

Multilateral

- Support for FPT Ministers, Deputy Ministers and Assistant Deputy Ministers of Agriculture.

- VP, Policy and Programs Branch, co-chairs the FPT Regulatory Assistant Deputy Ministers Committee

- PPB houses the FPT Regulatory Assistant Deputy Ministers Secretariat

- CFIA participates in multilateral health discussions through the Public Health Network Council, FPT Food Safety Committee, and the Chief Medical Officers of Health

- Officials from PPB, Science Branch, and Operations Branch also participate in numerous FPT working groups and multidisciplinary networks that include academic, science and industry representatives

Bilateral

- Operations Branch leads CFIA bilateral engagement with PTs on program and operational issues across food, plant and animal health business lines

FPT Multilateral Priorities

- FPT Ministers of Agriculture's November 2021 Guelph Statement endorsed 5 priorities: climate change/environmental protection; science, research and innovation; domestic and international trade; value-added agri-food and agri-products; and enhanced resiliency to respond to risk

- CFIA supports FPT DMs' and Ministers' discussions on African Swine Fever, Avian Influenza, Bee Shortages, Foot and Mouth Disease Vaccine Bank, Internal Trade, Potato Wart

- FPT Regulatory ADMs' priorities:

- Emergency Management: strengthening partnerships to proactively manage risks to Canada's food safety system, and plant and animal health

- Internal Trade: collaboration to enhance regulatory flexibility and innovation to enable interprovincial trade. Pilot projects being developed:

- Lloydminster (with SK, AB): to exempt SK and AB businesses that produce food for sale solely within their respective provinces from federal licensing and related requirements, enabling them to trade within the entire city of Lloydminster

- Slaughter availability (with MB, ON, QC): to enhance availability of slaughter services for livestock producers farming in remote border communities

- Ready to Grow (with AAFC, ON): to apply regulatory journey mapping exercise as first step to support the development of the Ready to Grow pilot for provincially-regulated meat businesses seeking to test market

Managing FPT relations: CFIA considerations

- Multilateral: Opportunity to strengthenstrategic input to FPT Ministers' discussions; linkages to overarching federal strategic initiatives e.g., Climate Change, Sustainable Development,Indigenous Reconciliation

- Bilateral: Agency's capacity is challenged in working directly with PTs on urgentoperational issues (e.g., Avian Influenza, Potato Wart) while also preparing for emerging threats (e.g., African Swine Fever, Foot and Mouth Disease)

- Internal: Opportunity to strengthen branch coordinationand information sharing to enableintegrated,value-added analysis and decision-making

Human Resources and Finance

Setting the Context

The CFIA currently manages a budget of $842 million (2023-24 Main Estimates)

- The Agency expenditures have two main envelopes: operating and investment

- The operating envelope generally represents over 90% of the agency's total resources

- The majority of this envelope is dedicated to the workforce (over 80% for pay expenditures)

- The investment plan (IP) represents the balance of the agency's resources (less than 10%) and varies depending on funding for temporary initiatives

CFIA Resources (in millions)

Planned Spending by Core Business 2022-23

| Core Business | Planned Spending (in millions) | Percentage |

|---|---|---|

| Safe Food | $373M | 44.45% |

| Internal Services | $171M | 20.44% |

| Animal Health | $148M | 17.69% |

| Plant Health | $129M | 15.36% |

| International | $17M | 2.06% |

Planned Spending by Type of Expenditures 2022-23

| Type of Expenditures | Planned Spending (in millions) | Percentage |

|---|---|---|

| Operating Expenditures | $645M | 77% (87% Pay and 13% Non-Pay) |

| Other Statutory | $97M | 12% |

| Statutory Revenue | $53M | 6% |

| Capital Expenditures | $43M | 5% |

Agency Spending Trend

Description for Agency Spending Trend

| Fiscal year | Total/Forecasted | Voted | Statutory | Sunset Programs | FTEs | Total/Forecasted FTEs | Sunset Programs - FTEs | Total FTEs with sunsetting programs |

|---|---|---|---|---|---|---|---|---|

| 2020–21 | 809.5 | 693.4 | 116.1 | - | 6,168 | 6,168 | - | 6,168 |

| 2021–22 | 824.5 | 696.4 | 128.1 | - | 6,546 | 6,546 | - | 6,546 |

| 2022–23 | 1,009.4 | 720.9 | 288.5 | - | 6,804 | 6,804 | - | 6,804 |

| 2023–24 | 884.5 | 691.4 | 150.7 | 42.4 | 6,287 | 6,579 | 292 | 6,579 |

| 2024–25 | 842.4 | 618.2 | 146.5 | 77.7 | 5,958 | 6,485 | 527 | 6,485 |

| 2025–26 | 820.8 | 598.5 | 144.6 | 77.7 | 5,830 | 6,357 | 527 | 6,357 |

This table is based on Agency-level financial and FTE information including the anticipated renewal of sunsetting resources for 2023-24 and future years.

Sunsetting programs are subject to government decisions to extend, reduce or enhance funding. The Agency will assess initiatives that are sunsetting and seek renewal, as required, to maintain and continuously improve Canada's strong food safety system, safe and accessible food supply, and plant and animal resource base. Following parliamentary approval, funding renewal decisions will be reflected in the Agency's budget authorities.

- The major increase of the Statutory spending in 2022-23 is primarily due to the Statutory compensation payments related to the Avian Influenza (AI) outbreak

- The increase in voted spending is also attributed to the AI emergency response

- The planned spending in 2024-25 and 2025-26 is less than in previous years, primarily due to the sunsetting (or discontinuation) of various initiatives

- When the anticipated renewal of sunsetting resources are included, the planned spending is forecasted to be more stable

CFIA Demographic Picture

Population by area and payroll status

Description for Population by area and payroll status

| Region | Active | Leave With Pay | Leave of Absence | Suspended |

|---|---|---|---|---|

| Atlantic | 892 | 2 | 40 | 2 |

| NCR | 1,962 | 11 | 122 | 0 |

| Ontario | 1,256 | 3 | 72 | 0 |

| Quebec | 1,115 | 3 | 79 | 0 |

| West | 1,826 | 2 | 117 | 0 |

Population by tenure

| Tenure | Population |

|---|---|

| Indeterminate | 6,088 |

| Other | 150 |

| Secondment | 0 |

| Student | 207 |

| Term | 1,075 |

| Summary | 7,520 |

Population by area

Description for Population by area

| Region | Population |

|---|---|

| Atlantic | 936 |

| NCR | 2,095 |

| Ontario | 1,331 |

| Quebec | 1,197 |

| West | 1,945 |

Population by gender

Description for Population by gender

| Gender | Population |

|---|---|

| Female | 61.0% |

| Male | 39.0% |

Population by Age band

Description for Population by Age band

| Age band | Population |

|---|---|

| <20 | 18 |

| 20-29 | 951 |

| 30-39 | 1,619 |

| 40-49 | 2,493 |

| 50-59 | 1,778 |

| 60+ | 665 |

Inspection Capacity

CFIA inspectors on the ground are an important element of the regulatory system, but they represent only part of the investments by the CFIA to protect Canadians

In fiscal year 2021 to 2022, the CFIA had 6,546 full-time equivalents (FTEs) dedicated to safeguarding food, animals and plants, which enhances the health and well-being of Canada's people, environment and economy

- 3,612 FTEs were used for the Agency's field inspection (3,018 FTEs) and laboratory professional capacity (594 FTEs)

- This includes work done by front-line inspectors, veterinarians and scientists in federally registered establishments, import service centers, field offices or laboratories

- 597 FTEs were used for the Agency's inspection and scientific specialist capacity

- This includes work done by chemists, biologists, scientific researchers, risk assessors and operational specialists

- 2,337 FTEs represented management and support capacity

- This includes work done by policy advisors, program managers, executives, statisticians, legal counselors, human resources advisors, financial management professionals, communications specialists, real property, material and acquisition services, information technology and information management specialists as well as students who collectively support safety outcomes

Separate Employer Status

As a Separate Employer (listed in Schedule V of the Financial Administration Act), the CFIA is similar to other Public Service organizations, in that it:

- Reports to a Minister, who in turn is accountable to Parliament

- Must serve the public interest, as well as service its clients

- Has many similar legal obligations to the rest of the Public Service, through the various acts applicable to it

- Has operational ties to other Public Service departments and agencies

- Requires Treasury Board approval of its mandate for collective bargaining and expenditures

- Has its staff represented by the two largest bargaining agents in the Public Service

- Shares a common culture with the larger Public Service

The President's authority under the CFIA Act provides the President authority to exercise flexibility in human resources management.

However, historically the Agency has sought to maintain alignment with relevant decisions and direction of the core public administration.

Future of Work: Return to the Workplace

- CFIA has been on-site a minimum of 1 or 2 days since September 6, 2022

- Currently, NHQ has a total of 1,476 unassigned, fully and partially enabled workpoints in Skyline and Camelot locations combined. This exceeds PSPC's Daily Occupancy Range calculation for CFIA HQ which is 800 to 1,200 on any given day at 2 days per week

- Some Area and Regional offices have space pressures causing difficulty to accommodate a distributed workforce. Corporate accommodations is working to identify where space is required since hiring practices through remote working shifted

- Area offices have been fit up with new IT peripherals and seating to replenish items that were brought home over the last 3 years; some items remain outstanding due to supply chain challenges

- Guidance related to the Future of Work (FoW) has been shared with employees since early 2022 and is currently being updated as appropriate to reflect the transition to the Common Hybrid Work model of 2 days on or before April 1, 2023; Agency-wide Town Halls, info-sessions and team meetings with FoW team members is ongoing

Common hybrid model – Proposed implementation plan for discussion

Description for Common hybrid model diagram

The common hybrid model proposed implementation plan was created for discussion purposes (this diagram is not intended for decision or approval)

The diagram displays a timeline which spans from December 2022 to April 2023

This pictogram for the timeline states the following:

- In December 2022, the CFIA adopted the common hybrid work model which was announced via email from the President and EVP

- As of February 6, 2023, the Future of work team along with its enabling partners would communicate to managers (prior to February 6) and to employees (on February 6)

- As of March 31, 2023 the following was proposed:

- Manager training, tools and advice

- My Work Arrangements (mWA) to be completed, adjusted or renewed as appropriate

- full implementation of two days per week at worksite required

- As of April 1, 2023 and beyond the following was proposed:

- Manager application of administrative measures

- Policy and guidance on progressive discipline available

CFIA Partners

International Partners

- Set import requirements, verify export requirements

- Comparability and acceptance of relevant systems (e.g., inspection)

- Develop international science-based rules, standards, etc.

Provincial, Territorial and Municipal Governments

- Enforce jurisdictional food safety, plant and animal health requirements

- Collaborate in responding to food safety incidents

- Prevent and manage plant and animal health emergencies

Federal Departments and Agencies

- Health Portfolio

- Agriculture and Agri-Food Canada Portfolio

- Global Affairs Canada

- Canada Border Services Agency

- Fisheries and Oceans Canada

- Environment and Climate Change Canada

- Natural Resources Canada

- Shared Services Canada

- Innovation, Science and Economic Development

- Public Service and Procurement Canada

Industry

- Production of safe food

- Comply with regulatory requirements

- Develop and implement best management practices

Consumers

- Safe food handling and preparation

- Awareness of plant and animal risks (e.g., transporting infested firewood)

Note: Separate briefings for early engagement with stakeholders will be set up at a later date

- Date modified: